Wa Liquor Tax Calculator. Wa Liquor Tax Calculator. Price:Size: Mini (50ml) Half Pint (200ml) Pint (375ml) Fifth (750ml) 1 Liter Half Gallon (1.75L) Gallon (3.5L)

If You are an Online Retailer Selling into Washington State, Read This!

In fiscal 2017, Washington’s liquor taxes and fees added up to $31.48 per gallon, down from a peak of $35.22 per gallon three years prior, according to the Tax Foundation. In a distant second

Source Image: bourbonveach.com

Download Image

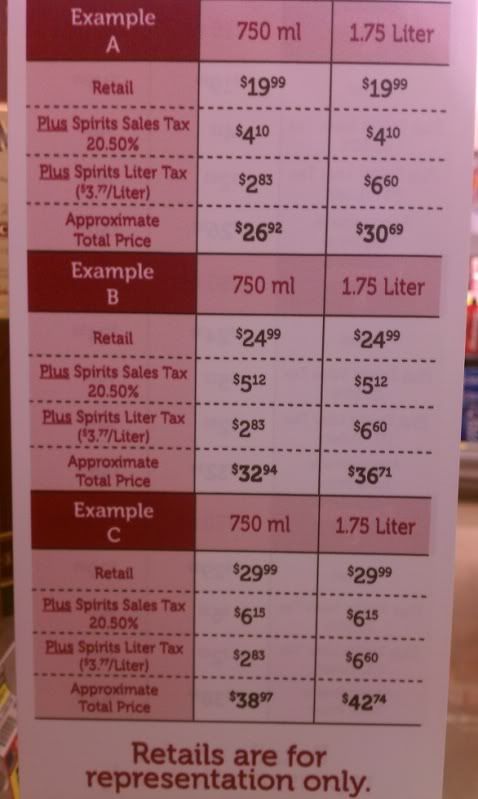

Dec 26, 2023The SST rate in Washington State is currently 20%, so the total tax would amount to $2.50. Therefore, the final price of the bottle of spirits, including the SST, would be $15. By understanding the process of liquor tax calculation in Washington State, both consumers and sellers can make informed decisions about their purchases.

Source Image: spokesman.com

Download Image

WA State Alcohol Tax (per .75 Litre) – Westland Distillery Feb 3, 2023The difference in taxes for the two types of alcohol in Washington has its basis in the initiative passed by voters in 2011 to privatize state’s liquor industry.

![The Most Popular Liquor in Every U.S. State [2022 Data Study]](https://upgradedpoints.com/wp-content/uploads/2023/02/upgradedpoints-liquor-graphic-v2_og_1920x1080.png?auto=webp&disable=upscale&width=1200)

Source Image: upgradedpoints.com

Download Image

How Much Is Liquor Tax In Washington

Feb 3, 2023The difference in taxes for the two types of alcohol in Washington has its basis in the initiative passed by voters in 2011 to privatize state’s liquor industry. The nonprofit Tax Foundation shows Washington’s liquor taxes as the highest in the country in 2010 — roughly $26.45 a gallon, compared to $24.63 in Oregon, $10.96 in Idaho and $3.30 in California.

The Most Popular Liquor in Every U.S. State [2022 Data Study]

Washington Wine Tax – $0.87 / gallon. Washington’s general sales tax of 6.5% also applies to the purchase of wine. In Washington, wine vendors are responsible for paying a state excise tax of $0.87 per gallon, plus Federal excise taxes, for all wine sold. Additional Taxes: Over 14% – $1.72/gallon. Liquor Sticker Shock: Why the tax on your receipt appears higher at some Huntsville bars | WHNT.com

Source Image: whnt.com

Download Image

Frongart Mountain Gin Private Selection 40% vol. Walcher Distillery… Washington Wine Tax – $0.87 / gallon. Washington’s general sales tax of 6.5% also applies to the purchase of wine. In Washington, wine vendors are responsible for paying a state excise tax of $0.87 per gallon, plus Federal excise taxes, for all wine sold. Additional Taxes: Over 14% – $1.72/gallon.

Source Image: karadarshop.com

Download Image

If You are an Online Retailer Selling into Washington State, Read This! Wa Liquor Tax Calculator. Wa Liquor Tax Calculator. Price:Size: Mini (50ml) Half Pint (200ml) Pint (375ml) Fifth (750ml) 1 Liter Half Gallon (1.75L) Gallon (3.5L)

Source Image: celerant.com

Download Image

WA State Alcohol Tax (per .75 Litre) – Westland Distillery Dec 26, 2023The SST rate in Washington State is currently 20%, so the total tax would amount to $2.50. Therefore, the final price of the bottle of spirits, including the SST, would be $15. By understanding the process of liquor tax calculation in Washington State, both consumers and sellers can make informed decisions about their purchases.

Source Image: shop.westlanddistillery.com

Download Image

Hercules Mulligan: Patriot, ‘Hamilton’ character, and a hot new liquor made in Upstate New York – newyorkupstate.com The graphic reveals that Washington leads the nation in excise taxes, collecting $35.31 per gallon as of January 2021, with Oregon a distant second ($21.95/gal). On the opposite end of the

Source Image: newyorkupstate.com

Download Image

Washington State (Liquor) Recruiting: A Five Store Evaluation – CougCenter Feb 3, 2023The difference in taxes for the two types of alcohol in Washington has its basis in the initiative passed by voters in 2011 to privatize state’s liquor industry.

Source Image: cougcenter.com

Download Image

Liquor Tax at Restaurants Now? : r/mildlyinfuriating The nonprofit Tax Foundation shows Washington’s liquor taxes as the highest in the country in 2010 — roughly $26.45 a gallon, compared to $24.63 in Oregon, $10.96 in Idaho and $3.30 in California.

Source Image: reddit.com

Download Image

Frongart Mountain Gin Private Selection 40% vol. Walcher Distillery…

Liquor Tax at Restaurants Now? : r/mildlyinfuriating In fiscal 2017, Washington’s liquor taxes and fees added up to $31.48 per gallon, down from a peak of $35.22 per gallon three years prior, according to the Tax Foundation. In a distant second

WA State Alcohol Tax (per .75 Litre) – Westland Distillery Washington State (Liquor) Recruiting: A Five Store Evaluation – CougCenter The graphic reveals that Washington leads the nation in excise taxes, collecting $35.31 per gallon as of January 2021, with Oregon a distant second ($21.95/gal). On the opposite end of the